Tax season

What students need to know about taxes

Don't fret, just be prepared this tax season

caption

April 30 is the deadline for individuals to file their taxes.

caption

April 30 is the deadline for individuals to file their taxes.T.S. Eliot wrote, “April is the cruelest month” in his poem The Waste Land. Many Canadians would agree since April 30 is the final day to file your income tax return.

The word “taxes” usually gets a negative reaction from adults, young or old. To first-year university student Beth Airton, her reaction is anxiety.

“It just seems like a very adult thing, so whenever I hear taxes I think I have to be a stiff adult in a business suit,” she says.

Airton’s reaction isn’t abnormal. Many students are intimidated by the fact that they come into university without any knowledge on how to do taxes, since it is often not taught in schools.

Whether you choose to go it alone or hire a professional, here are some tips on how students can make sense of taxes.

Know your options

Doing taxes on your own is free and possible with the right amount of planning. However, it is not the method the professionals recommend.

The Tax Depot’s Joel Gillis has been filing taxes for people for more than 20 years. He is a chartered professional accountant (CPA) and has taught business at the university level. His financial advice has also been featured on This Hour Has 22 Minutes.

Gillis recommends going to a certified professional to do your taxes no matter what your situation.

“It may sound self-serving, but it’s because of all the mistakes I’ve seen in over 20 years of doing this that I say that.”

If you want professional help you need to pay for it. Most tax firms in the HRM offer discounts or lower rates for students, usually ranging from $40-$100.

Another option for students in the HRM is booking volunteer help at the Halifax Public Library, which offers help with filing taxes to students, seniors, and lower-income families at most of its branches.

Be prepared

Airton received a T4 form for her part-time employment before coming to university. She did not file her tax return that year.

“This isn’t a thing I should be ignoring, but I don’t know what to do with it,” she says.

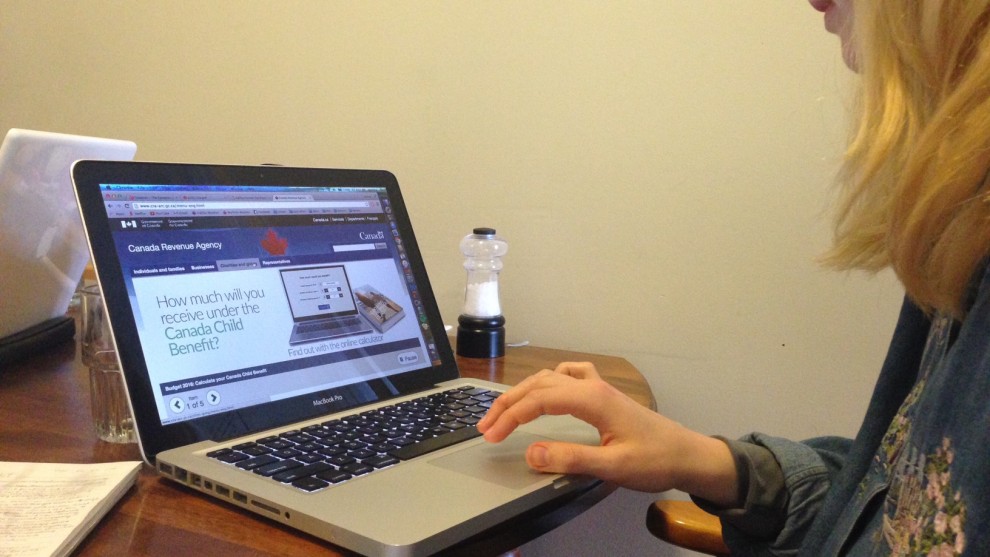

Whether you’re filing on your own or hiring help, having all of the appropriate forms is the first step. The Canada Revenue Agency (CRA) has a list of what forms you need to find.

If you don’t file online, paper forms can be found at any Canada Post or Service Canada office.

caption

Joel Gillis says people should hire a professional to do their taxes.Gillis recommends that international students check if they should file in Canada. Tax credits may be available depending on their residency status. The CRA has advice for international students on its website.

Why you should file

Everyone in Canada who files for their 2015 tax return is allowed to claim $11,327 for themselves.

Since most students are unemployed or part-time workers and can claim more money for things like tuition, they rarely owe taxes. Instead, they often receive money back.

Gillis recommends filing every year so students take advantage of all of the tax credits they receive for expenses like tuition.

He also cautions students to not hand off their taxes to their parents for an easy fix. There are some tax credits that can be filed by either parents or students, and it’s important to assess what the best options are for the student for future filing.

Computers can be your friend

While filing on paper is possible, it’s a process University of King’s College student Emma Morris deems “a nightmare.”

Online tax software is a method some people use to file their taxes every year. Gillis warns to do your research before selecting software. Though often user-friendly, they can often be flawed or miss finer tax details a human would catch.

Here are three tax software sites that were recommended by students:

Relax, have fun!

Morris enjoys talking about doing her taxes.

“It feels kind of like a game where you’re like, ‘I’m going to get a whole bunch of money back,’” says Morris.

“To me it kind of feels like voting where it’s … your thing to do for society.”

However, there are other methods to making taxes fun.

“What I think about when I think of taxes is getting drunk on a spring evening. Usually red wine, that’s my drink of choice,” says University of King’s College student Paisley Conrad.

Conrad’s method of filing her taxes is to get all of her papers in order, set up her tax software of choice, then drink some sangria.

“The first time (doing taxes) I didn’t get drunk, and it wasn’t very fun,” says Conrad.

Whether you go professional or do it on your own, hopefully students will find their April a little less cruel this tax season.