Investing in the pandemic economy

caption

Gen Z and Millennials have an edge over their predecessors in investing due to technologyMillennials and Gen Z take a new approach to stock trading

Charles Frédette was excited to receive his first brokerage account information folder from his father. He was just 10 and overwhelmed with the new responsibility, and felt the need to do something in his new role as a young investor. He immediately took out his highlighter and started marking “important” stuff in his new paperwork. Just like he has seen his father do many times before.

“Buying a stock in a company is like buying a hockey card of a player. It may not be worth a lot right now, but if the player has a great career and is a good sportsman, the same hocky card could be worth millions of dollars someday,” says Frédette’s father.

Charles received his first lesson in stock investing from his father that day. He bought his first stock in 2013 with the money he made mowing lawns during the summer break.

Fast forward a few years and Frédette, now 19, and his friend Philip P. Becker – an IT expert – are planning an investment competition for their school in Quebec. Both are CEGEP students from Marianopolis College in Westmount, where they started an investment club. Last September, Charles received a phone call from Ryan Dollinger, who wanted to start something similar in his school at Collégial Sainte-Anne.

They had the same goal: to educate themselves in investments because it was something they were not learning in school.

That phone call lasted for hours and a competition they devised for their friends at school turned into an idea to expand the stock investment competition for teenagers in Canada and the United States, using an innovative web and mobile portal with virtual money. The winning prize was set at $10,000.

The Young Investors Challenge is a registered Canadian not-for-profit organization. Its investment simulation enables young investors to learn about stock trading without risking real money.

“Everything was canceled, I didn’t have anything going on, I was looking to do something like a purpose,” Dollinger says, recalling when the pandemic began last year. But Dollinger is not the only one who was looking for a way to learn about investing and stock trading during the pandemic.

New players in the field

The year 2020 has seen in the stock market what the previous pandemics have witnessed as well. Wild market swings became the norm but this time there is another player in the field – technology.

David Harrison, manager of investor education and communications at the Nova Scotia Securities Commission, says he has seen a huge increase in the number of young people educating themselves on stock trading since last spring. The commission tracks web traffic on its online platforms, such as YouTube, and its website.

The pandemic has made millennials look around and think, ‘how can we do well financially?’Rob Carrick, Globe and Mail columnist

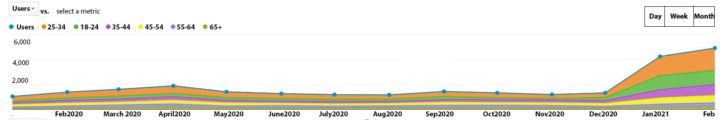

“At the outset of the pandemic in March,2020, we saw a near 30 per cent increase in traffic on our website, mostly around our investor education resources,” he said in an email interview. “This included a 40 per cent increase in website users between the ages of 25 to 34.”

caption

Nova Scotia Securities Commission Web Analytics for the year 2020-2021In January 2021 this changed considerably. The commission saw a 220 per cent increase in traffic to its website. It was such a dramatic rise in users that staff double-checked to make sure it was not an error. Most of this traffic was users looking at investor education content, especially content focused on stocks and stock market investing. During the same time, there was a 300 per cent increase in website users between the ages of 25 and 34.

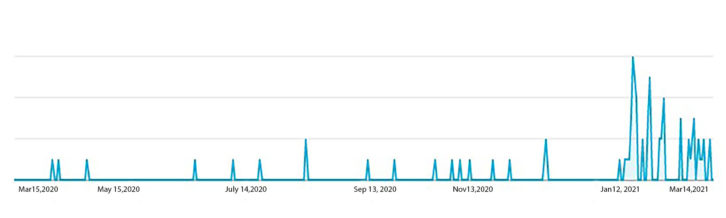

They commission has also seen an increase in traffic on its YouTube channel, especially for the videos on stock investing, pump and dumps and investment fraud.

caption

Nova Scotia Securities Commission YouTube analytics for pump and dump and investment fraud videosPublic and Finimize found that 80.9 per cent of millennials believed investing is the right way to build wealth in the pandemic economy.

Every generation leaves its marks on the economic demographics of the world. But baby boomers had larger-than-life impact on the growth of world capital, thanks to solid economic growth, newer inventions and fat pensions.

Millennials have faced challenges from the beginning. They are making far less money than baby boomers did when they were the same age. They have delayed financial milestones such as home ownership and have more student debts and less financial security than their parents.

With more than two economic crises in a decade (the 2007 to 2009 recession and now a pandemic), millennials are less likely to end up with a car, let alone a house. Is this the only reason which has led to the increased frenzy of millennials buying stocks?

Searching for investment options

Rob Carrick, a financial expert and columnist with The Globe and Mail, says millennials are interested in the stock market because they have a little money and feel shut out of the housing market.

“They will never be able to save the down payment (for a home),” he says in an interview. “They will never be able to manage the mortgage. Housing is now, more than ever, is seen as an investment, and if you are shut out of it then stock market looks pretty inviting.”

Millennials do not have the same opportunities to build careers and achieve success as previous generation.

“The pandemic has made millennials look around and think, ‘how can we do well financially?’ The housing is expensive, great jobs and big promotions and pay raises are hard to find but the stock market is going up and up and up like a rocket. It is accessible on their phones with no fee and a lot of money is being made,” says Carrick.

caption

Rob CarrickOne of these millennials is Greg Horne, 26, who has been trading on his own with a brokerage since 2016 and considers it a hobby or a side job. His profession is geotechnical engineer.

He thinks the influx of young traders in the market is because of new technology and low-fee online brokerage platforms, which have enabled low-income and middle-class people to buy stocks.

Horne says that 10 years ago someone who wanted to invest would approach an investment firm or brokerage with at least some capital. New apps such as Wealthsimple and Robinhood allow someone with just $50 to invest with no commission fee.

The GameStop saga

The GameStop incident only fueled the ready, set, go mindset of millennials to do something about their financial situation. Probably one of the most interesting things to see in the GameStop episode was how quickly people sorted themselves in two groups, bringing populism to Wall Street.

It’s a scheme. The whole premise behind it is artificially inflated stock, which they called a meme stock, something that’s not valuable or is on the trend of losing value like GameStop.Greg Horne

Many appreciated the blow to hedge fund investors caused by WallStreetBets, or WSB, a sub-Reddit and a social media platform where participants discuss stock and option trading. They were termed a righteous force by millennials and Gen Z and by those feel the system favours billionaires over the common person.

The crusading group of retail traders on WallStreetBets bid up the price of GameStop to target hedge fund investors, who were shorting the stock of GameStop, causing them huge losses in funds. Later, Robinhood, the mobile app where the whole GameStop incident took place, restricted the buying of several stocks, citing “market volatility” as a reason.

But GameStop also showed that investing in stock market is not a game.

“It’s a scheme,” says Horne. “The whole premise behind it is artificially inflated stock, which they called a meme stock, something that’s not valuable or is on the trend of losing value like GameStop.”

It was a perfect storm because of the pandemic. A lot of people are working from home and they have the flexibility to look at day stocks. People who don’t have jobs are looking for new ventures and opportunities.

They have bet on stocks in bankrupt and seemingly doomed companies and tapped on their screens to load up on shares. They stuck up for GameStop retail chain when it was pushed to bankruptcy by hedge fund managers.

The seasoned investors of Wall Street think the manic millennials and crazy Gen Z have taken lessons on Reddit of “how not to invest.”

Carrick feels the GameStop incident was revealing. It shows that young investors are willing to listen to each other. They are open to the idea of consulting with each other and building a community of young investors and using that information to buy stocks.

He thinks this is a new development that reveals how social media is changing investing. It shows how young investors are willing to take a position to make a point and not just money, although some did make a lot of money.

Changing behaviour

A survey of more than 3,000 American adults by Public.com and Finimize.com shows a massive shift in approach to stock market.

Money is no longer a taboo topic on social media. Of those respondents who invest, 75 per cent said they talk to other people about their investments, with 63 per cent of investors turning to friends or online communities as their starting point for such conversations. The youngest cohort of respondents, 18- to 29-year-olds, were significantly more likely to discuss investing and financial strategies with their friends prior to making their investments.

The self-directed young investors who have entered the investment playing field are getting their financial information from TikTok, Reddit and other unconventional sources. The surge of digital assets such as Bitcoin is more relatable for young investors than baby boomers, who are more heavily invested in bonds. Time favours young investors, while baby boomers are less than likely to jump on the bandwagon to risk their retirement funds.

According to the survey, 37 per cent of respondents seeking financial advice go to their friends first, followed by communities and forums (26 per cent), family (21 per cent), and professional coaches or advisors (15 per cent).

caption

Young Investors Challenge web displayHorne says the pandemic has provided an opportunity to millennials sitting at home with their CERB and stimulus cheques to find a new way of making money.

The employment rate is slowly bouncing back but the pandemic has done its job. It was a wakeup call for many people that things can change for the worse if we are not prepared. Retirement and unemployment are not just numbers but a reality. But the changing demographics in the investing landscape have not been the same as in previous pandemics.

The Wall Street Journal says the economists tried to zero-in on stock market similarities after the Spanish flu epidemic (1918 to 1920), which bears similarities with COVID. The initial similarities between the two pandemics are turning out to be misleading. The market seems to have recovered from the Covid crises yet, according to the Journal.

“The economic uncertainty has been far higher during the current pandemic than it ever was then.”

Stock market trends

Wall Street might have to take young investors seriously. This may not turn out to be a temporary frenzy.

Four years ago, the last of the baby boomers turned 65. The savings of millennials and inheritance windfalls will boost the assets of millennials, making them a big player in investment decision-making. It would be a mistake to assume that millennials will have the same investing behaviour as their parents.

Charles Frédette says he realized at young age that many older people don’t have the financial freedom because they did not have the financial literacy to make calculated decisions. The Young Investors Competition is only one way that technology will change the investment behaviour of young people in the coming years.

About the author

Zarnigar Khan

Zarnigar Khan can be reached for story ideas on her Twitter account @ZarnigarKhan5