Few think they will be victims of investment fraud until they are, says educator

Event at Halifax Library aimed to educate people about risks and types of scams

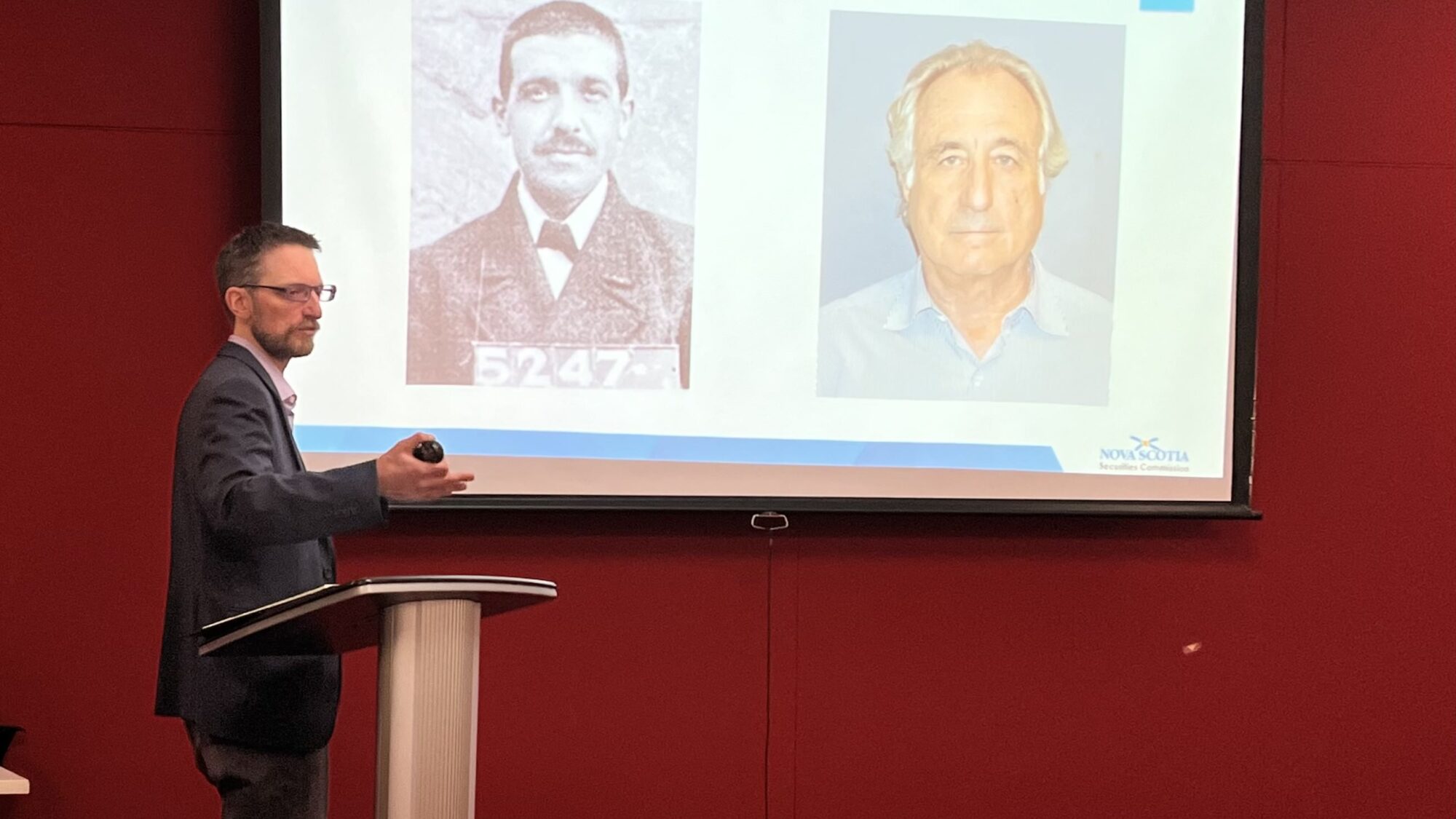

caption

David Harrison delivered a talk on investment fraud at the Halifax Central Library on Thursday night. He asked viewers to name the men in the photos: Charles Ponzi, an early 20th century con man after whom the Ponzi scheme is named, and Bernie Madoff, who engineered a $65 billion scam before he was arrested in 2012.Only handful of listeners were at a lecture on investment fraud on Thursday night.

David Harrison, an investment educator, says it’s because most people don’t think they’ll ever become victims of fraud.

“If people were to raise their hands about what kind of fraud they think they would be a victim of, they wouldn’t say investment fraud,” said Harrison, who works for the Nova Scotia Securities Commission (NSSC).

“That’s what everyone who experiences fraud will say a month before they are defrauded.”

Studies show more young people are being affected by fraud, part of an overall rise in investment fraud.

“No matter what demographic you fall in, we’ve seen victims from 18 to 90 in Nova Scotia in the last couple years,” said Harrison. “We’ve seen all demographics become victims of fraud, whether they’re losing $100 or $300,000.”

Investment fraud ‘more prominent than ever’

Investment fraud is the largest scam affecting Nova Scotians by dollar amount. In 2023, investment fraud took $4.9 million from Nova Scotians, according to an RCMP release.

A Cole Harbour man was defrauded $210,150 last month. He lost the money in an online cryptocurrency scam advertised via social media. According to Harrison, investment fraud is on the rise because of the internet.

Harrison says social media “unfortunately increases the amount of victims, which increases the amount of money being lost.”

Are young people more likely victims?

A 2022 report from the Canadian Anti-Fraud Centre stated young people are being increasingly targeted by fraud operations. The 18–24 year-old demographic are more likely to be online, and less likely to understand fraud as a threat.

The Canadian Securities Administrators 2024 survey report found 82 per cent of 18–24 year olds use at least one social media platform to learn about investment. But that doesn’t mean young people are likelier victims – 53 per cent of all respondents to the survey use social media for investment advice, an 18 per cent increase from 2020.

Monthly lecture

The presentation is part of the NSSC’s monthly series on investment. The lecture on investment fraud has the lowest turnout, Harrison said.

The talk covered warning signs and different types of fraud, and how to report an incident to the NSSC.

In the presentation, Harrison showed the CSA’s National Registration Search, advising investors to look up anyone selling securities to ensure their practice is legal.

And, he cited the Nova Scotian man who scammed churchgoers out of millions in 2011 as an example of affinity fraud, a scam that targets a particular community.

Harrison sees more young investors in his Investing 101 and DIY Investment seminars. He says those attendees are “interested in learning about investing, which is a good way to avoid fraud in general.”

Harrison is hopeful the library lecture program will help investors make safe choices.

“The greatest defence against fraud is education and knowledge,” said Harrison. “And we try to supply that as best as possible.”

Correction:

About the author

Jennifer Waugh

Jennifer Waugh holds a BA in social justice from Saint Mary's University. In spring 2025 she will graduate with a Bachelor of Journalism degree...