Bitcoin

Cryptocurrency: Half bank, half stock exchange, half wire service

Electronic currency exchanges explained

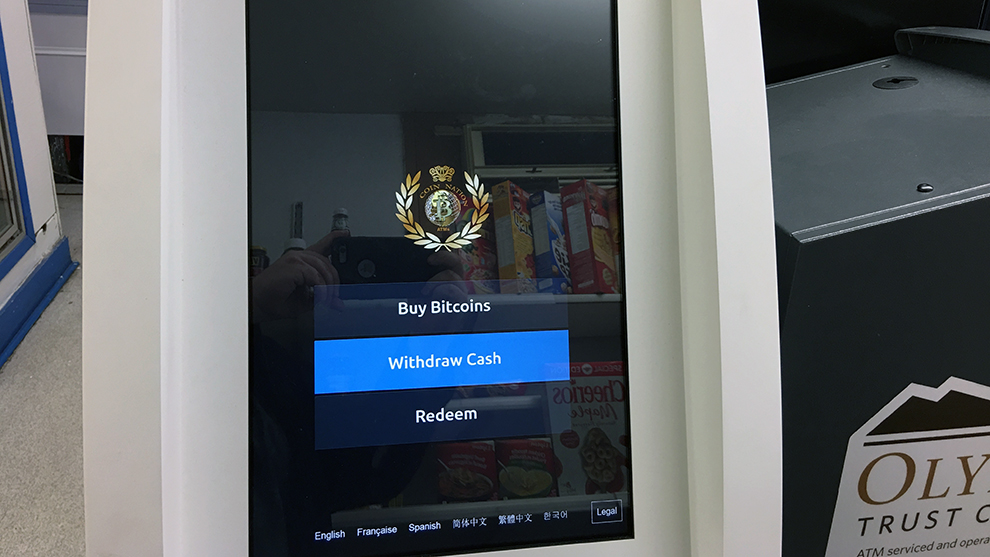

caption

Coin Nation hopes to install two to three Bitcoin machines per month.The story behind the collapse of Bitcoin exchange QuadrigaCX is making headlines in the crypto world, but for those not familiar with cryptocurrency it can be confusing.

“It’s like a stock exchange,” said Adam Goldman, founder and president of bitbuy, one of Canada’s largest Bitcoin exchanges. “It’s even closer to more of a (foreign exchange) market place.”

Trading crypto

Despite being electronic, currencies like Bitcoin need a place to trade. This is where companies like the late QuadrigaCX come in.

As a crypotcurrency exchange, QuadrigaCX was a place where users could store, buy and sell cryptocurrencies like Bitcoin, Litecoin, and Ethereum. Related stories

To buy and sell on QuadrigaCX, users were required to create an account, called a wallet, to put cryptocurrency or traditional money in. Some exchanges don’t require identification to open an account, but most exchanges, QuadrigaCX included, require users prove their identity. This usually involves users taking a picture of themselves with their government-issued photo ID clearly visible.

According to a promotional video QuadrigaCX posted to its YouTube channel on June 6, 2016, the exchange accepted bank wires, money orders or deposits from their bank accounts. Although, in 2018, most Canadian banks blocked transactions associated with cryptocurrency due to concerns about money laundering.

Once the money was on QuadrigaCX, users could buy, sell and trade cryptocurrencies with other users.

Virtual banks

Like a bank, QuadrigaCX held the bulk of its users’ money in a storage space similar to a bank vault. In the crypto world, these vaults are known as cold wallets. Exchanges make most of their money in transaction fees for facilitating users’ trades. Normally these trades would happen through a hot wallet, but hot wallets aren’t as safe as cold wallets.

Hot wallets are used for daily transactions, like bank tellers. These transactions need to be approved, so a lot of people within the exchange have access to it. Since it’s the main point of contact for users, it’s also fairly exposed and vulnerable to hacks. This is why, when hot wallets have amassed too much money; exchange administrators send money to cold wallets to keep it safe.

Despite their similarities, banks and cryptocurrency exchanges are different.

“You have to be very careful in this industry as to whether we use certain language,” said Goldman. Describing a crypto platform as a bank or exchange could have specific legal definitions, and requirements.

Goldman said bitbuy is a “trading platform,” software that allows users to interact with the cryptocurrency networks.

The differences

Banks are highly regulated. Quadriga’s exchange went down, in part, because the money wasn’t accessible to users, something the Bank Act has strict rules about. Banks need to have cash on hand to cover a percentage of the money clients have there. There is no such regulation in place for Canadian cryptocurrency exchanges.

Another major difference is that trading in crypto is public, but anonymous. The ledgers for cryptocurrency transactions are called blockchains. Blockchains are public, and when a transaction happens, it’s logged in sequence in the blockchain and locked in. Anyone can see the amount moved, when it is moved, which wallet it moved from and which wallet it moved to. The anonymous part is wallets are identified by a random series of letters and numbers. There isn’t any personal information attached to them.

However, it is possible to find specific accounts as a blockchain allows users to follower their money.

“They can follow the path that any specific transaction takes,” said Goldman. If a user knows whom they’re sending the money to, they can use that information, with information from the blockchain, to identify specific accounts.