SCAMS

Seniors staying sharp in face of online, telephone fraud

CARP explains the scams that target seniors

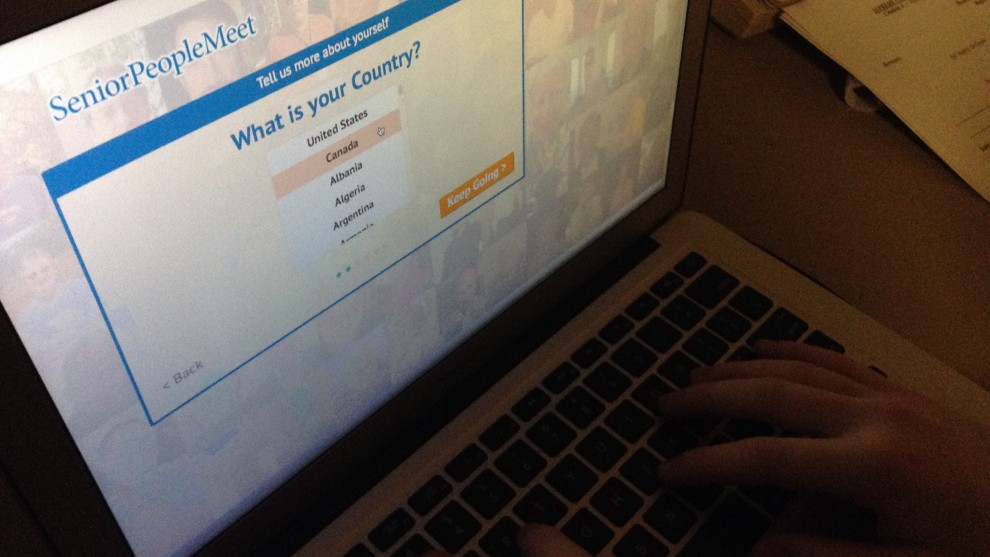

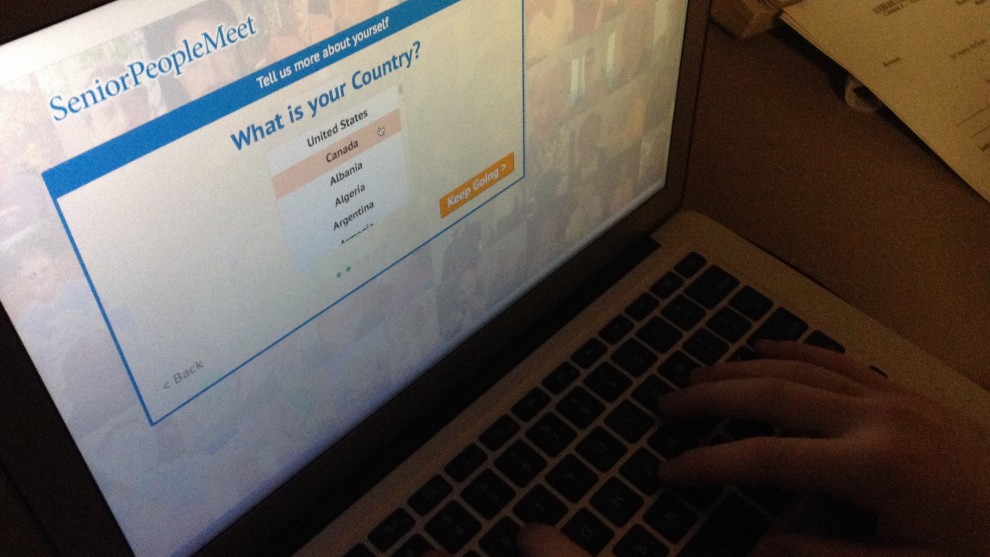

caption

Seniors are a frequent target for romantic scams.

caption

Seniors are a frequent target for romantic scams.March is Fraud Prevention Month, and seniors in Nova Scotia are taking measures to stay sharp against con artists.

“Fraud is as much of a crime as robbery, but instead of using a gun they use lies and deceit,” Ian MacDonald says.

MacDonald is the vice-chairman of the Canadian Association of Retired Persons Nova Scotia branch. Earlier this month, CARP hosted presentations to educate Nova Scotian seniors on preventing fraud.

Last year, the Canadian Anti-Fraud Centre released a national advisory warning the elderly to beware of emergency scams. The RCMP retweeted the CAFC’s national advisory earlier this month.

Make sure they love you, not your wallet. Scammers only care about your money. Meet locally. #FPM2016 https://t.co/EceC1FII5u

— Canadian Anti-Fraud (@canantifraud) March 16, 2016

An emergency scam, also called a grandparent scam, targets senior citizens to defraud them of money.

The fraudster tricks the senior into believing they are their grandchild. The fraudster conjures up a situation where they are in financial trouble and then guilts the victim into wiring them money through money transfer companies like Western Union.

“Fraud can come in a variety of different ways,” MacDonald says.

MacDonald says that emergency scams aren’t as popular as other types of fraud. He says that the recent Canada Revenue Agency scam targeted many seniors.

Romance or trickery?

“On the internet you really don’t know who’s on the other end,” MacDonald says.

According to the Canadian Anti-Fraud Centre, in 2014 romantic fraud took $14 million out of Canadian pockets. MacDonald says that these scams usually take place online and target retired people.

In this scenario, seniors who are active on social media or have an online dating profile are targeted by fraudsters under the guise of another identity. Often photos are downloaded off of other people’s social media pages and used in online dating sites to lure victims into romantic pursuits. The fraudster tricks the victim into lending them their credit card number in order to get out of a fake financial problem.

How to outsmart a con

MacDonald says that the presentations happening this month at CARP are helping seniors become more cautious of scams.

He has a few pieces of advice for seniors.

First, MacDonald says to get educated and participate in presentations and programs offered by CARP and the Canadian Anti-Fraud Centre.

“The way we teach is pretty neat,” MacDonald says. He says CARP uses role playing and sketches to demonstrate what fraud looks like in a variety of different situations.

Online resources like ABC’s of Fraud also help promote fraud awareness and offer support.

Second, MacDonald says that if it sounds too good to be true, then it is. He advises seniors to contact experts like banks or doctors if they are offered investment opportunities or cheap pharmaceuticals.

Third, MacDonald advises seniors to get a credit check once a year. He says that if your identity has been stolen the thief could be using your credit and you wouldn’t even know.

Finally, MacDonald advises seniors to not carry their Social Insurance Number card or birth certificate on them. These pieces of information could result in identity theft if they fall into the wrong hands.

MacDonald says that often times fraud isn’t reported to police because people are embarrassed to admit to being defrauded.

John Verlinden, spokesperson for Northwood, a non-profit continuing care organization for senior citizens, says that Northwood seniors are working to overcome embarrassment.

“It’s not an embarrassment to let someone know. If you keep it a secret that means they are moving onto another victim and if we had had that information or warning, we would have prevented that fraud from taking place.”