Mortgages

Owning a condo at 21? It’s a good bet, if you can swing it: bank rep

A banking specialist explains why it could be a good time to buy in Halifax

caption

A house for sale in Halifax, N.S.

caption

A house for sale in Halifax, N.S.Dalhousie University student Peter Earley has owned a condo in the north end for five years. Right now, he’s living with his parents while he rents it out.

To him, the arrangement is basically free money.

“I consider 70 to 80 per cent of the money I spend on housing each month a capital [investment]” he says. “Because I’m not spending it.”

Stephanie Morrison, a banking specialist at Credit Union Atlantic (CUA), says that a lot of young people aren’t aware they might qualify for a mortgage, and says housing can be a great investment.

“Rather than paying rent to never own something, you’re getting a mortgage and you’re just paying yourself back,” Morrison explained. “Most people just look at a mortgage like paying themselves.”

Owning property at a young age is daunting and can be difficult. The job market in Halifax is tough. The housing market? A different story.

Once someone has a job, it takes surprisingly little income compared to other larger cities to get a mortgage. Earley, now 21, was earning $30,000 a year as an apprentice chef in 2011 when he bought his condo.

Earley’s condo is worth around $150,000 today.

Up front costs

As a consequence of the financial crisis in 2008, stricter regulations have been put in place for banks regarding how much and to whom they may lend money.

To buy a condo similar to Earley’s today, Morrison says you would likely need to earn between $42,000-$50,000 to qualify for a mortgage with Credit Union Atlantic.

“The basic rule of thumb is your total debt can’t exceed 42 per cent of your income,” Morrison explains.

Buyers typically need to put 20 per cent down on any property purchase upfront, or they will need to qualify for and purchase mortgage insurance with the Canadian Mortgage and Housing Corporation (CMHC).

Buyers also need to set money aside for lawyer and transfer fees, Morrison says. Fees vary, but potential buyers can count on needing an extra two to three per cent of the purchase price in cash.

For Earley, $5,000 of his down payment came from a separate $5,000 line of credit.

A haven for buyers

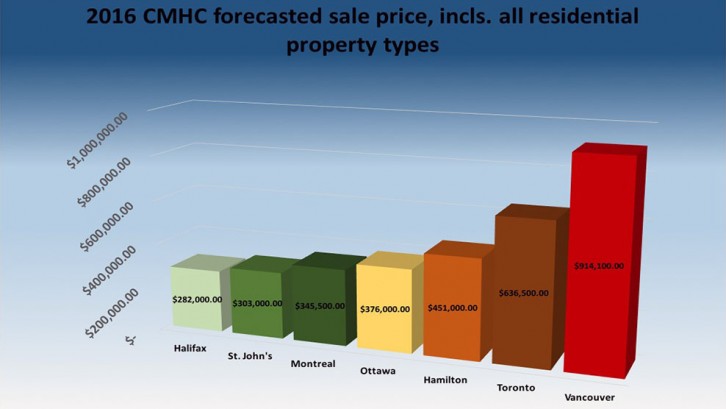

Compared to the rest of the country, Halifax is a bargain. The CMHC estimates that a house in Hamilton, Ont. will cost $451,000 this year. Toronto? Add another $200,000 or so. And winning the lottery still might not get you a house in Vancouver.

caption

Chart: Jesse Laufer. Source Data: CMHC 2015The low prices don’t mean that Halifax is going to be the next big house flipping market. Prices are going up, but the CMHC says not by much.

Still, there’s a little bit of money to be made, or at least saved on rent.

Earley says his property is worth about $20,000 more now than it was four years ago. He’s also “paid himself” about $15,000 by chipping away at his mortgage. He currently rents his condo for about $1,100. If he was paying that amount in rent over the last four years, he’d have spent $52,800. Instead, he has an extra $35,000 in home equity.

There are of course risks involved with getting mortgages. Morrison says the biggest is over-extending your debt. Banks recommend having access to enough funds to pay a few mortgage bills in case of financial hardship. But people often get over-extended by borrowing too much, too quick, for things like renovations and furnishings, Morrison says.

“They get in there and they go crazy,” she says of some customers. “All new furniture, all new appliances. Everything brand new. All in the first year. And then they come to me crying, asking to refinance their mortgage because they’ve incurred so much debt.”

If mortgage payments aren’t being made, properties can be foreclosed, a process where the lender takes possession of the house. Perhaps the worst part about being foreclosed on is you likely won’t be able to get a mortgage for a decade due to a damaged credit rating. But banks don’t like doing that and Morrison says it’s used as a last resort.

After a foreclosure, getting another mortgage can be difficult, or at least very expensive, as a result of the damaged credit rating. But Morrison says banks try to find other solutions and foreclose only as a last resort.

Her advice if things get tight is to contact a bank before payments start being missed.

Still, both Morrison and Earley would suggest getting into the market as soon as you can, if you can stand the cold Maritime winters.

“Something could turn around badly for Halifax,” Earley admits. “Trudeau might cancel the ship contract and there might be a massive upset. Or you know a ship might explode in the harbour again. But barring these big unforeseen, it’s a pretty stable market.”

What $150,000 can get you in Halifax

[idealimageslider slug=”what-a-150k-condo-in-halifax-looks-like”]