Workers say minimum wage isn’t enough to pay the bills

Inflation is outpacing wage increases, say employees

caption

Teasha Mercer is paid over minimum wage and says it’s still not enough.Shane Campbell welcomes the province’s planned increase to the minimum wage on April 1. But, with the increase in prices of food and rent, he’s struggling.

“When I get my paycheques and then I look at what my rent is, there’s a big difference,” said Campbell, who is paid the minimum wage of $15 per hour working at a large retail clothing outlet.

“I can’t seem to work enough hours to make my rent, let alone groceries.”

The minimum wage is set to increase by 20 cents in April. But according to the Canadian Centre for Policy Alternatives, that was still $11.30 below what a family of four in Halifax needed to live in 2023.

The centre pegged the hourly rate for a household in the city with two-full time workers and two children meeting its basic needs at $26.50 an hour.

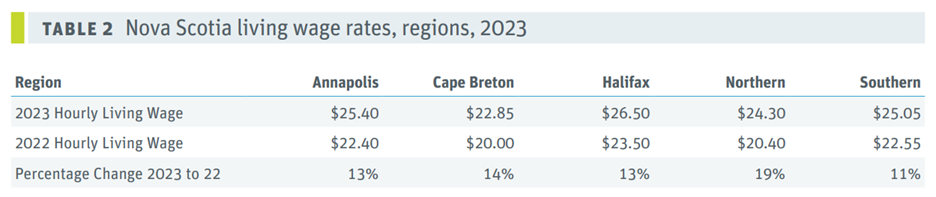

caption

This table outlines living wages in Nova Scotia.According to a report released by United Way Halifax in January, Nova Scotia has the highest provincial poverty rate in Canada. In Halifax, rapid increases in housing and food costs have made it more difficult to meet basic needs, with rent in the province increasing by 8.3 per cent in 2022. In comparison, from April 2021 to April 2022, minimum wage increased by about three per cent.

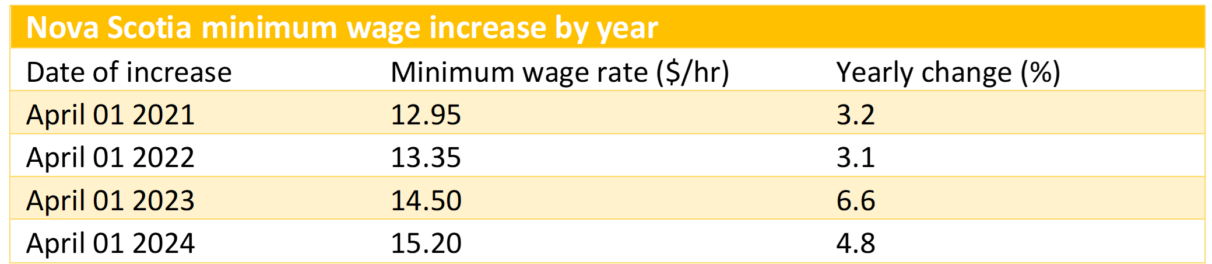

caption

This table demonstrates Nova Scotia’s yearly minimum wage increases since April 1, 2021.The province last increased its minimum wage — to $15 — in October. Overall inflation in the province was 3.6 per cent in December, compared to December 2022. But food costs were up 6.7 per cent in the province and shelter costs were up 5.8 per cent.

Even workers who are paid above minimum wage say they aren’t making enough to live in the current economy.

Teasha Mercer, who works at an ice cream shop in Halifax, is paid more than minimum wage but says it’s still not enough.

She says within six years, her rent increased by $1,000. “When I first moved out, I was paying $700. Now I’m paying $1,700,” she said.

According to United Way Halifax’s report, vacancy rates for affordable units in 2021 and 2022 were less than 0.6 per cent, driving up rent, and 10 per cent of homes for sale last August were over one million dollars.

Leen Kaur, an assistant manager at a jewelry and hair accessories chain, is paid above minimum wage. She says the extra 20 cents will only pay for a coffee each week.

“I always thought (if) you work hard, you get something … but it’s not a thing anymore,” she said.

John Bachmann agrees. The manager of Xtreme Pizza Halifax says businesses can no longer afford to give raises based on performance.

However, he says businesses are now tackling expensive leases, insurance, taxes and pandemic debt. “Every time you work harder, the raise is going to be the cost of living,” rather than reflecting an employee’s effort.

caption

John Bachmann is the manager of Xtreme Pizza Halifax and says businesses can no longer afford to give raises for performance.Just up the street, Tart & Soul Café has recently increased most of its prices by 15-20 per cent. Saf Haq, co-owner of the café, says they pay their employees above minimum wage.

“We had just been eating the cost of inflation for a while and we finally realized that if we wanted to stop doing that, we had to bite the bullet and increase the price(s),” Haq said.

Haq said a large part of the café’s costs are employee taxes, which rise as wages rise. She said governments will have to provide support, such as subsidies or tax breaks, if workers are ever to be paid a living wage.

caption

Co-owners of Tart & Soul Café Saf Haq and Lisa Brow do prep work for the week ahead. The café recently increased its prices in response to rising inflation.Duncan Robertson, a senior policy analyst with the Canadian Federation of Independent Business, says the province needs to better fund public services so the living wage can be reduced.

“Placing it at the feet of recovering small businesses is … it just isn’t realistic,” he said about paying a living wage.

If the province made public transit, health care, housing, and child care more affordable, Robertson said this would offset the gap between the living wage and the minimum wage.

Robertson also said the province should rethink how it determines minimum wage. The province reaches this number by adding one per cent to the consumer price index, used to measure inflation, with the goal of allowing workers “to share in the economic growth of the province.”

Robertson said this one per cent is an arbitrary number. Instead, he wants to see the minimum wage based on a percentage of the median income.

The Department of Labour, Skills and Immigration said in a statement the province has taken steps to support Nova Scotians, including making “significant cost of living investments to reduce fees for childcare,” and creating “new affordable housing initiatives.”

About the author

Andie Mollins

Andie is from Shediac, a small but lively beach town in New Brunswick. She studied history and sociology at the University of New Brunswick and...