Victims of July floods struggle to navigate disaster assistance program

544 Nova Scotians filed claims following July floods linked to climate change

caption

Owner of Pete'za Perfect Peter Theoharis stands behind the counter of the shop in Elmsdale.Pete’za Perfect has served the Elmsdale community pizzas, donairs and fresh clams for the past nine years. But when the area was flooded by 250 millimetres of rain this past July, the pizza shop was forced to close.

The shop reopened its doors on Oct. 9 and owner Peter Theoharis says business is finally picking up despite a slow start. Due to having to lay off employees, Theoharis says he has lost two full-time workers and is forced to work in the shop almost every day.

“It’s a lot of down time for a business to be closed that long,” he said.

Theoharis tried applying to the province’s Disaster Financial Assistance Fund. The program provides up to $200,000 in uninsurable losses for households, small businesses, and not-for-profit organizations. In order to receive funding, people need to submit documentation of denied claims.

According to Theoharis, he was unable to apply to the program because insurance companies told him he would have to wait until the new year to see if his claims were approved, and the deadline to apply was Oct. 31.

“The whole thing was overwhelming,” said Theoharis. He wanted to reopen his business as soon as possible, so he decided to fix most of the flood damage on his own. He is still hoping to get some money back from insurance.

caption

Flood waters inundate the parking lot at Pete’za Perfect on July 22.Uninsured and uninsurable

Theoharis’s frustration with the fund’s application process is shared by others who are confused about the program’s intent, according to the province’s insurance industry.

“The language on the [disaster financial assistance application] form addresses two key words: uninsured and uninsurable,” said Jennifer McLeod, chair of the Insurance Brokers Association of Nova Scotia (IBANS) in a phone interview.

“They really look close as words, but they mean complete worlds of difference,” she continued. McLeod explained that the fund is meant to help insured individuals and businesses who are unable to receive flood damage coverage because they’re in an area prone to severe flooding.

However, confusion is arising as uninsured individuals, who themselves refused coverage offered to them by their broker, are being encouraged by municipal and provincial officials despite being ineligible.

“We are hearing that municipal and provincial officials were encouraging even the uninsured people to apply,” said McLeod. “That didn’t guarantee that they would get approved, but they were being encouraged to at least try.”

McLeod added the application’s complexities are compounded by limited consumer expertise when it comes to insurance.

“A lot of the time what we are seeing in today’s environment is insurance is treated as a commodity, something that people are looking to save money on,” she said.

“When somebody might be looking to get insurance on their own, without fully understanding all of the endorsements, and you’re coming at it asking, ‘How do I get the cheapest insurance?’, people are not going to buy the enhanced coverage,” said McLeod.

“And then when the worst-case scenario happens, now they have questions. And now they’re stuck without coverage at the worst possible moment in their lives,” she went on. “And that’s a scenario none of us want to see happen.”

Water is the new fire

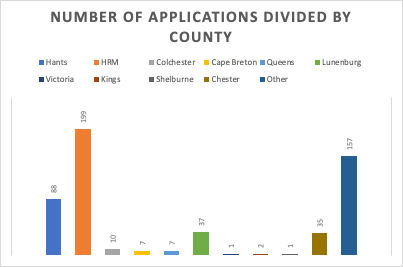

A freedom of information request to the province’s Emergency Management Office (EMO) revealed 544 Nova Scotians applied to the Disaster Financial Assistance Program to claim damages from the floods this summer.

caption

This chart shows the number of applications to the Disaster Financial Assistance Program following the July floods, sorted by municipality.Nova Scotia’s July flooding broke weather records for the province. Environment Canada meteorologist Bob Robicheau attributes the unpredictability to climate change.

Robicheau said that while staff anticipated a heavy rainfall event of 100 mm, the 200-plus mm of rain that fell across the province in July was not predicted by historical weather models. Climate change scenarios project that flooding will be the province’s greatest challenge.

“Given those scenarios, what would be the main hazards over the next century? The top two from now until 2040 are flash flooding and river flooding, stuff that we just saw over the last few months,” said Robicheau.

Will Balser of the Ecology Action Centre agrees that people can expect severe flooding to become more common.

“A rainstorm that would have happened 50 years ago would not have affected our communities nearly as badly as if that same storm happened today.”

He said this is because “we’ve destroyed a lot of our wetlands … we’ve cut down a lot of trees and overgrowth forests that would have soaked up that water in the first place.”

As flooding intensifies in the province, insurers will have a harder time in assessing risk. McLeod recalled flooding so intense in Cape Breton in 2016 that water was pushed through storm grates into homes on the highest hilltops, affecting people who had never once thought they needed overland water insurance protection.

“Water is the new fire. You never knew where fire was going to come from. Well, now water is doing the same,” says McLeod. “Climate change is changing everything. So the only way to really look after yourself is to put the proper coverage in place, and making sure that you understand all of your policy coverages and policy limits.”

IBANS and the federal government are working together on a national flood plain strategy.

‘We know that some people are still struggling’

When a severe natural disaster occurs, the province can request support from the federal government through the Disaster Financial Assistance Arrangement. Following the July floods Nova Scotia launched the Disaster Financial Assistance Program, distributed by the EMO. This program was also used following hurricane Fiona and the wildfires this summer.

When asked how the deadlines to apply for this funding are set, Nova Scotia’s EMO spokesperson Heather Fairbairn explained: “In general, the deadline for applications is three months after the program launch.”

The deadline to apply for the funding was 101 days after the July floods, which was Oct. 31.

“These events were devastating and we know some people are still struggling,” she said. For hurricane Fiona, the deadline was extended due to “the impact and widespread nature of the storm.”

Fairbairn said there would be no extension of the application deadline for the July flooding.

“As long as the application is received before the deadline, we work with applicants until the required documentation is complete and the file is closed,” said Fairbairn.

Pete’za Perfect owner Peter Theoharis is unconvinced.

“A lot of businesses are still closed, and they don’t know if insurance is going to help them yet or not,” said Theoharis. He believes some small businesses would have benefited if the deadline to the program was extended.

About the author

Hope Edmond

Hope Edmond is a master's of journalism student from Enfield, Nova Scotia. She enjoys sharing the stories of others.

Jacqueline Newsome

Jacqueline is a proud King's Master's student from Toronto who loves to write about matters of public safety.