Young Halifax residents struggling to afford the basics with low income, high inflation

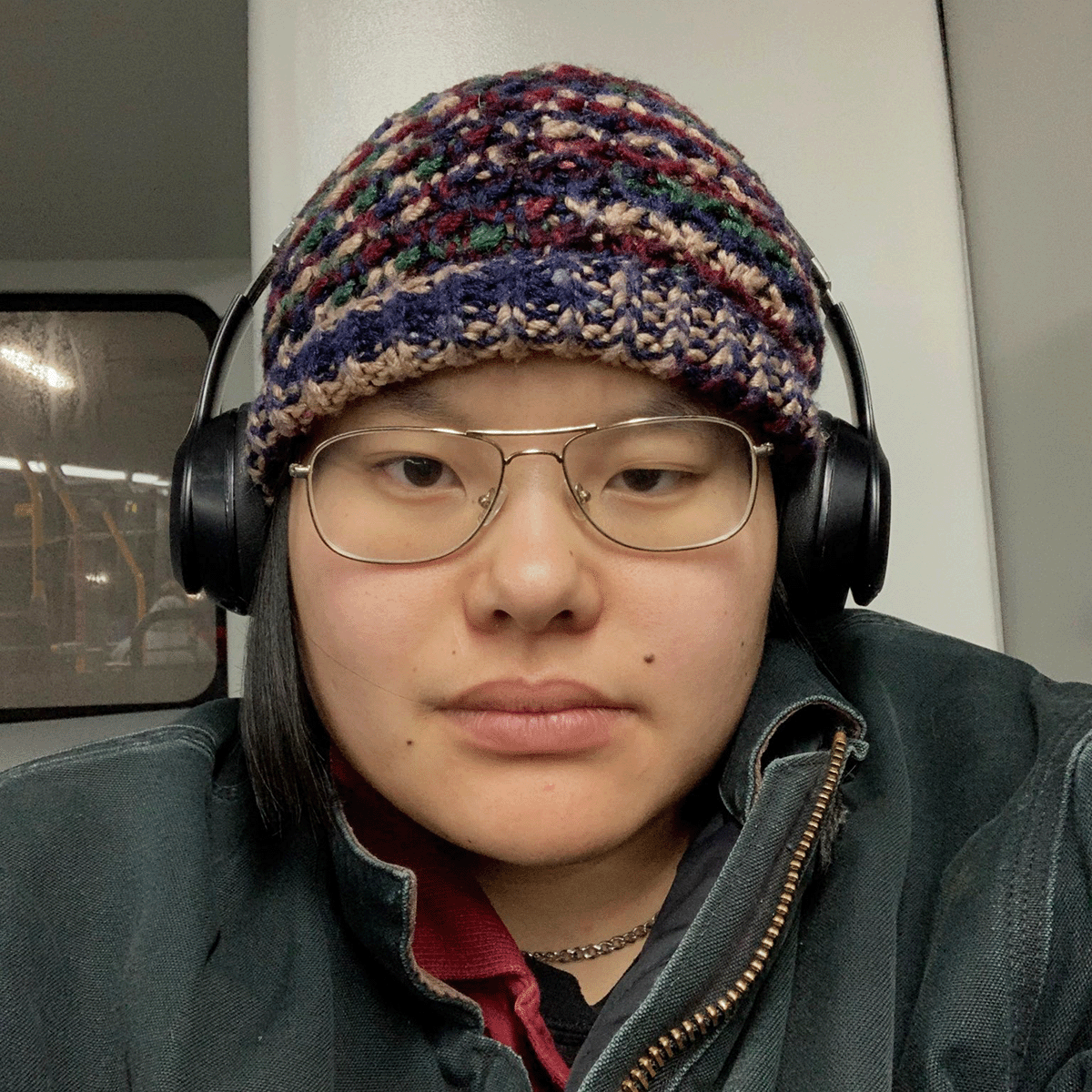

caption

Jasper Lennox (they/them) is a 23-year-old, full-time minimum wage worker in the customer service sector.Those in their 20s have among the lowest wages in Canada

Seven-hundred and fifty dollars worth of free groceries from a stranger on the internet sounds too good to be true.

Yet Halifax resident Jasper Lennox was surprised to receive gift cards totaling that amount in March after responding to a Reddit user’s offer of help for Haligonians struggling to meet basic needs.

“I couldn’t believe it was real,” Lennox, 23, said in an interview with The Signal, adding that the gift cards will help buy food while searching for a new apartment and saving for a security deposit for May.

Lennox, who works a full-time, minimum wage job in customer service, is struggling to pay the bills.

“It has been really, really hard the past year.”

Statistics paint a troubling picture of low wages for young Haligonians

Lennox is not alone. Halifax remains one of the least affordable Canadian cities for people in their 20s, especially when it comes to having the income to afford food, rent and energy bills, according to analysis by The Signal.

Out of 36 Canadian cities, Halifax has the 33rd lowest average hourly wage ($22.23) for people aged 20 to 29, according to customized Statistics Canada data obtained by The Signal.

Nova Scotia’s minimum wage of $14.50 is also tied for the fourth-lowest in Canada. In contrast, the living wage in Halifax is $23.50, according to a 2022 report from the Canadian Centre for Policy Alternatives, Nova Scotia.

This gap between the living and minimum wages amounts to at least $10,000 annually, says Christine Saulnier, director of the centre’s Nova Scotia branch and author of the living wage report.

Minimum wage earners “work primarily in retail trade, followed by food and accommodation” and close to three-quarters are age 35 or younger, according to the latest report from the province’s minimum wage review committee.

“There are a lot of reasons we should feel that this generation is really stuck,” Saulnier said.

About one in four workers in Halifax aged 20 to 29, like Lennox, work in the retail, food and service sectors, according to an analysis of Statistics Canada data.

At the same time, inflation continues to impact Haligonians.

Skyrocketing food and housing costs are eating into wages

“For the past few years, prices have been going up significantly higher than wages, so that means a decline in the real wages of Canadian workers,” said Dalhousie University economist Lars Osberg, who researches economic insecurity.

He said food and rent are hitting wallets the hardest.

Inflation caused a nearly five per cent cut to wages for the average Nova Scotian in 2022, according to the Centre for Policy Alternatives report.

“[My partner and I] only really feel that we can afford food when it’s on the 50 per cent off reduced rack or aisle,” Lennox said.

“If it’s other kinds of foods we don’t really bother because we can’t afford fresh vegetables or fruits and even basic items like butter and milk.”

The province’s food inflation reached 11.5 per cent in November 2022, a rate not seen since 1981 according to the Consumer Price Index.

Meanwhile as of March, Halifax’s rental housing inflation rate of 8.6 per cent is tied for the second-highest out of 16 Canadian cities.

“I’ve met so many people at work who are working two jobs, which they shouldn’t have to just to afford their bedroom and afford groceries,” Lennox said.

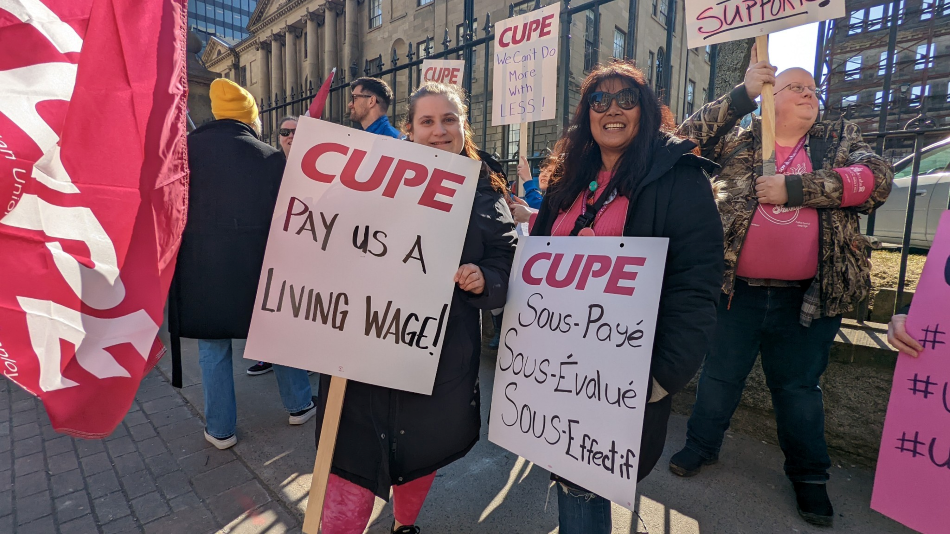

caption

Protestors hold signs calling for higher wages in front of Province House in Halifax on March 21, two days before the Nova Scotia government tabled its 2023-24 budget.What solutions are needed?

Raising the minimum wage is not a “silver bullet”, says Duncan Robertson, Nova Scotia policy analyst for the Canadian Federation of Independent Business, a lobby group for businesses with fewer than 500 employees.

“If we want to really address the affordability issue, government has to take steps on policy above and beyond minimum wage, [on things] like housing, food, inflation, fuel,” he said.

Robertson said the scheduled $15 minimum wage on Oct. 1, an accelerated $1.40 increase from one year prior, is “putting immense stress” on Nova Scotia small businesses, adding that many are still recovering from the pandemic.

“Fifty-two per cent are still paying back pandemic debt averaging around $102,000,” he said.

Policies beyond minimum wage increases were highlighted by the experts who spoke with The Signal, including Osberg and Saulnier.

Public services can be expanded, according to the Canadian Centre for Policy Alternatives report which states “the more generous government programs, services and income transfers are, the less employment income workers need.”

Municipalities, for example, could offer free or low-cost public transit, said Karen Chapple, director of the School of Cities at the University of Toronto.

“If you help reduce people's transportation costs, then [their income] is going to go a lot further,” she said.

With housing, Chapple said each level of government must “align housing policies better in order to build a lot more housing in cities, but also preserve the existing affordable stock that we have.”

Still, income is a factor, with Chapple saying “we don't really have a housing crisis, we have an income crisis.”

The executive director of the Restaurant Association of Nova Scotia says his industry is recognizing that higher wages are “the thing they should do. "You have a happy employee, you have a good employee,” Gordon Stewart said.

What the Nova Scotia government is doing for young people

In its 2023-24 budget, the province says supporting youth is one of its priorities.

”Nova Scotians under 30 in this province have a very unique benefit that I’m not aware of any other jurisdiction that has it,” Premier Tim Houston told The Signal following the province’s budget announcement on March 23.

An existing program, which returns provincial income tax paid on the first $50,000 earned for tradespeople under age 30, was expanded in the budget to include nurses. $20.9 million is budgeted to deliver this program.

The budget also includes $3.4 million as part of a four-year, $13 million commitment to Mitacs “to create up to 3,200 more paid internship opportunities for post-secondary students.” Mitacs is a national not-for-profit providing training and paid work opportunities to students.

$1.3 million is allocated in the budget to increase the income threshold at which people on the province’s Repayment Assistance Plan will not have to make any payment on their student loans, among other changes.

In an emailed statement to The Signal, the Department of Labour, Skills and Immigration says it works with organizations outside government “to pursue youth employment goals, including our partnership with NPower Canada, which provides free IT training and has already helped more than 200 low-income Nova Scotian youth secure careers in IT.”

For Lennox, they feel the “government and the council [aren't] doing their job to make [Halifax] an affordable place for people who live here.”

Looking to the future

Halifax is growing rapidly and has the second-highest growth rate of all Canadian cities, according to a report released in January by Statistics Canada.

“The key decision for governments today to make, [is] if they can invest to make growth a positive thing for most people, rather than a growth in misery and congestion and scarcity,” Osberg said.

Although their current financial situation is stressful, Lennox is looking to the future with some hope.

After buying groceries with the free gift cards, Lennox asked their mysterious benefactor how they could thank him.

“He just told me to pay it [forward] in the future, which I really intend to do when I'm in a better financial situation,” Lennox said. “I hope I can do that for a lot of people.”

With files from Crystal Greene.

Editor's Note

This story is part of a series in The Signal examining how and why Halifax is one of the most unaffordable Canadian cities for adults under 30 years old. Poor well-being is, according our research, a byproduct of the inability to cover basic expenses such as food and rent because of low wages.

About the author

Andrew Lam

Andrew Lam (they/she) is a Chinese and trans journalist interested in labour, LGBTQIA+, and political stories. They hope to leverage their data...